Updated November 2022.

The below list of average customer lifetime value (LTV or CLV) benchmarks for services companies is based on data from our 12 years of working with 200+ clients, a good deal of which provided services.

After the list, we share our formula for calculating LTV / CLV for a service business along with guidance on customizing the formula for your company. If you are a marketing manager who has used LTV before, you know that the calculation can be as much an art as a science. However, it is, along with customer acquisition cost (CAC), the most important metric you have for informing decisions on marketing investments.

Average LTV / CLV for Various Services Businesses

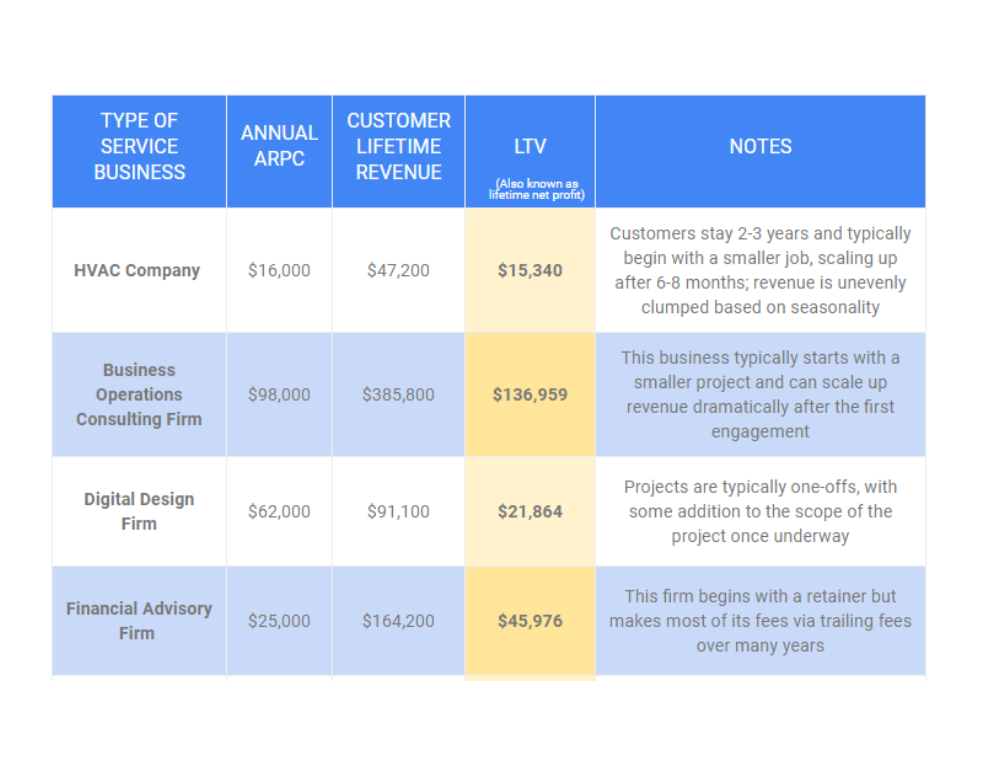

In this table, we list the average LTV for a range of service businesses. In this sample, these companies are mostly B2B companies that attract local business in Silicon Valley, San Francisco, or Sacramento. Since these areas have a high cost of living, LTVs may be higher than they would be for a business based in a less expensive city.

We’ve included the annual average revenue per customer (ARPC) for each business along with the LTV. These two metrics relate to each other in that a business’s annual ARPC multiplied by the amount of time a customer continues paying the business is one way to calculate LTV. (More on the nuances of calculating LTV in the next section.)

Average Customer Lifetime Value (LTV) for Services Companies

Type of Service Business |

Annual ARPC |

Customer Lifetime Revenue |

LTV(Also known as lifetime net profit) |

Notes |

| HVAC Company | $16,000 | $47,200 | $15,340 | Customers stay 2-3 years and typically begin with a smaller job, scaling up after 6-8 months; revenue is unevenly clumped based on seasonality |

| Business Operations Consulting Firm | $98,000 | $385,800 | $136,959 | This business typically starts with a smaller project and can scale up revenue dramatically after the first engagement |

| Digital Design Firm | $62,000 | $91,100 | $21,864 | Projects are typically one-offs, with some addition to the scope of the project once underway |

| Financial Advisory Firm | $25,000 | $164,200 | $45,976 | This firm begins with a retainer but makes most of its fees via trailing fees over many years |

| Commercial Insurance Company | $38,000 | $321,000 | $125,190 | Insurance companies typically maintain client relationships for many years, earning revenue from premiums + interest from investing premiums |

| Medical Billing Firm | $21,000 | $88,300 | $26,932 | These firms maintain clients for many years, with revenue coming from fees — hourly, by claim, or a share of collections |

| Software Development Firm | $144,000 | $237,000 | $69,915 | This firm earns money through a standard time & materials model but many other models exist |

| Addiction Treatment Business | $77,000 | $110,200 | $35,815 | Treatment centers typically charge program fees and, if residential, housing fees as well, with opportunities for services expansion |

| Architecture Firm | $682,000 | $1,129,000 | $135,480 | Revenue comes from swaths of time and material costs, segmented into phases over several years |

| Healthcare Consulting Firm | $164,000 | $328,600 | $96,937 | This firm generates revenue from hourly fees like all consulting firms, with project size and scope typically increasing over long-term relationships |

How to Calculate LTV / CLV for a Services Business

Service companies calculate LTV a bit differently than, say, a SaaS or eCommerce company, where the revenue model is often simplified by subscriptions and monthly recurring revenue. Here is the quick and dirty way to get the lifetime value of a customer for a service business:

| LTV = Average Revenue Per Customer (Annual) × Average Customer Lifespan x Gross Profit Margin |

To get more precise in our LTV calculation, we need to consider several other variables about a new customer. You can use them as you wish based on your knowledge of your own company.

- Likelihood (and value) of service expansion

- Likelihood of new customer referral

- Likelihood of reference or case study

Let’s look at an example using all the variables. We will base them on our own services firm, an SEO agency.

|

Our firm’s average revenue per customer (ARPC) in their first year is $120,000. (We will use first year revenue as a baseline, since we often see service expansions in later years.) Our typical customer stays with us for 41 months, or 3.4 years. So far, our LTV is $408,000 if the client does not expand their campaign. Now it’s time to factor in the variables listed above, along with our gross profit margin. Likelihood of Reference or Case Study. There is clear economic value in a new client acting as a reference or case study for your sales team, but given how difficult to measure it is, for the purposes of this case study we’ll simply note that our LTV will be somewhat higher than the result we calculate. Likelihood (and Value) of Service Expansion. Clients expand their services with us about 43% of the time over the course of a campaign. The average expansion value varies quite a bit, but the average is $84,000 / year, beginning in year 2. Over a 3.4 year lifetime, the services expansion totals $201,600 in additional revenue. So far, our LTV has increased to: $120k x 3.4 + (.43 x 201,600) = $494,688 Likelihood of New Customer Referral. On average, 37% of our clients refer new customers to us. Of those customers, a new contract closes ~30% of the time. Our client acquisition cost is usually $20,000, but a referral client only costs us $5,000 to close. So a referred client brings us savings of $15,000 vs. a non-referred client. We can now calculate the additional value each new customer brings relative to their likelihood of referring another customer: $15,000 x .37 x .3 = $1,665 At this point, our LTV has increased to: $494,688 + $1,665 = $496,353 Gross Profit Margin per Customer. With an average gross profit margin of 20%, we can now calculate the gross profit per client: $496,353 x .20 = $99,270.60 LTV |

The impact of LTV is that your company can then back into a CAC, as it is reasonable to say that the sales and marketing departments combined can spend absolutely no more than that amount to acquire a new customer. Most firms would allocate up to 33%—but ideally 25% or lower—of the LTV to acquire an additional customer.

Next Step: How to Acquire Customers

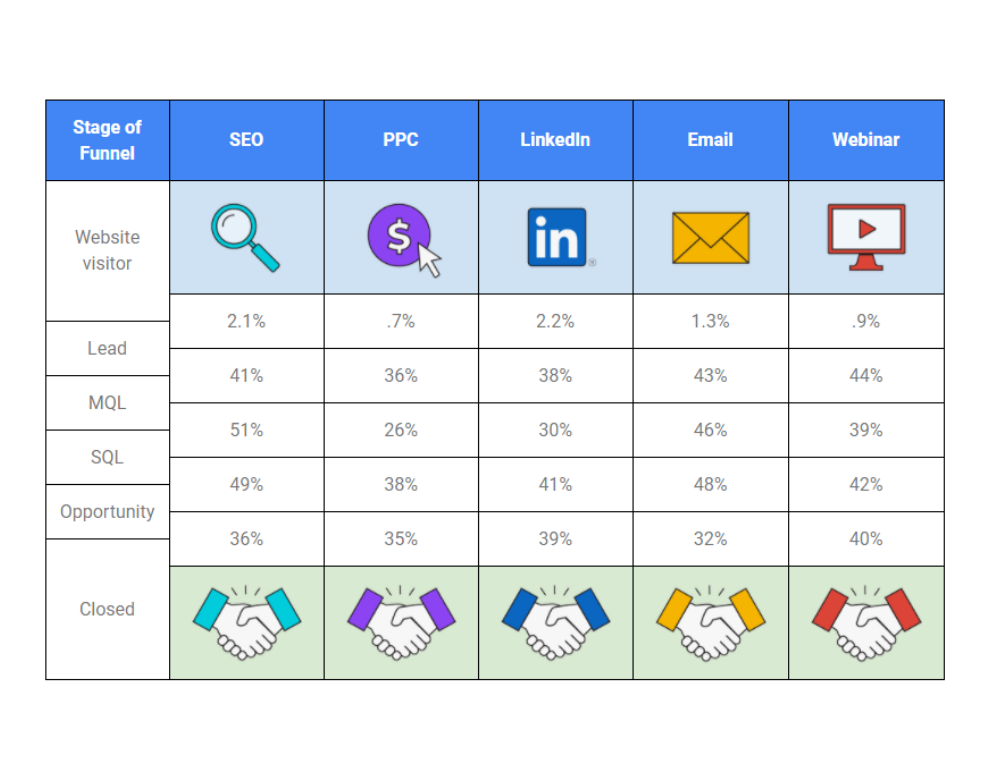

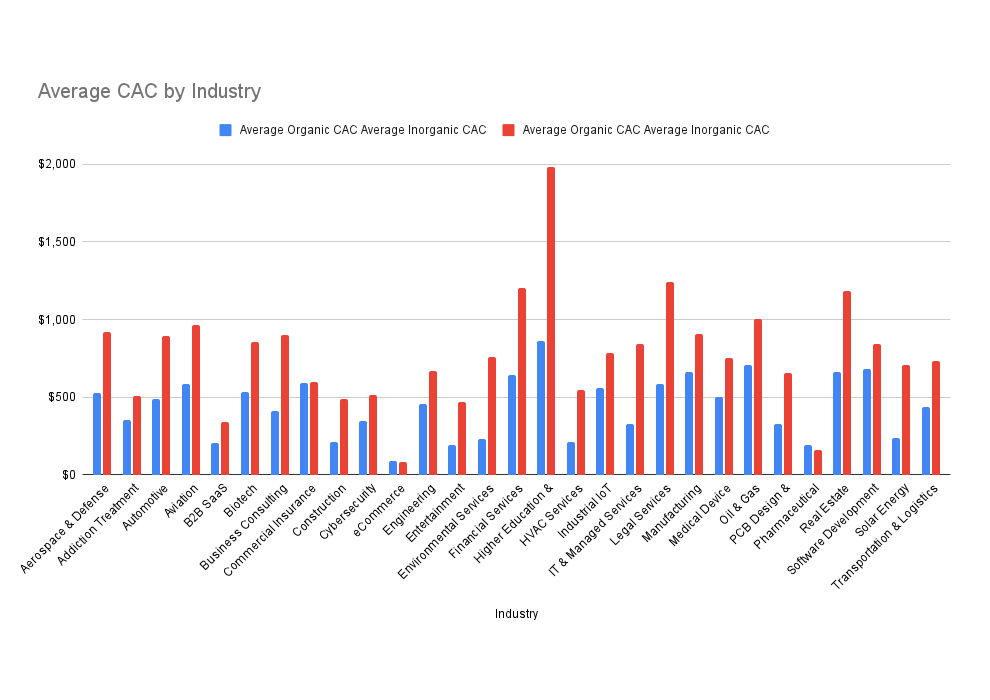

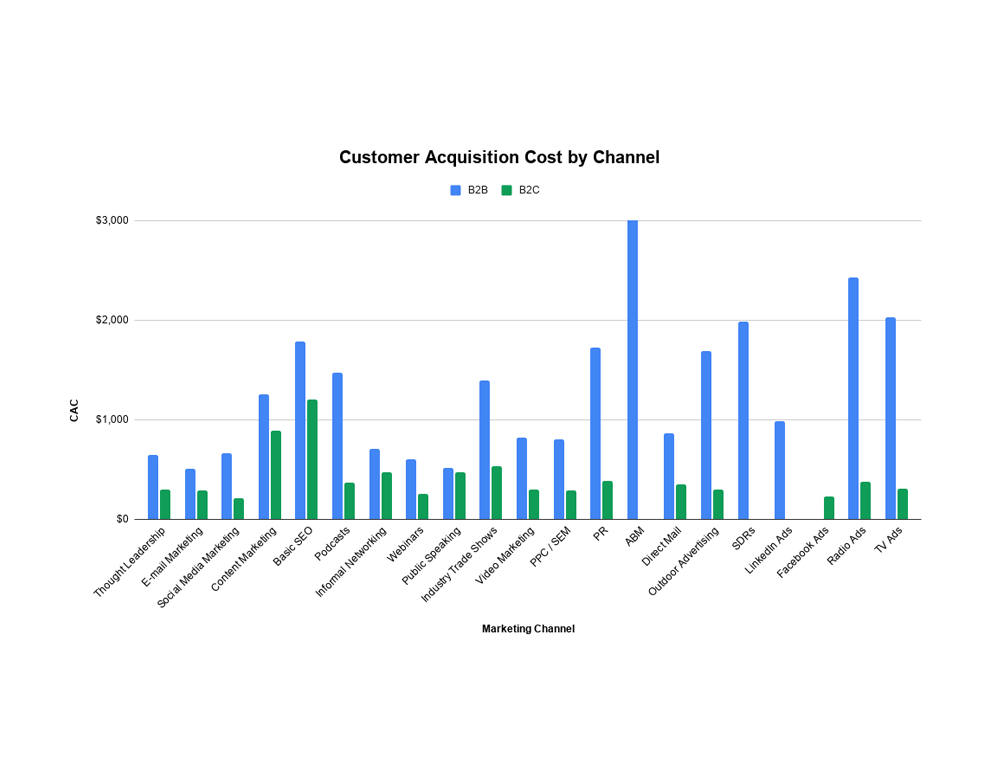

Once you know your average customer LTV—and by extension, how much you should be spending on acquiring new customers—you can decide which marketing channels make sense for your business to invest in. If your existing CAC is higher than 33% of the LTV you’ve calculated, there’s a problem with your current acquisition strategy. One of the most common causes is an overreliance on inorganic channels: if you rely entirely on PPC or other paid advertising to generate new leads, you’ll need to pay “market rate” for each new lead and your CAC will be higher than if you had invested in organic marketing.

If you’ve found this discussion useful and would like to discuss ways to increase your LTV to CAC ratio, feel free to get in touch. We’re experts in helping businesses use SEO to lower their CACs and build sustainable lead generation systems that generate reliable ROI.

Further Reading

To take a deeper dive into LTV and CAC statistics, we recommend: